Allowable Deductions For Web Design Business 2022

Allowable Deductions For Web Design Business 2022

14 cents per mile driven in service of charitable organizations. Adjusted reference margin 70 420000. This means it can work out cheaper which is one of the main reasons. Generally you cannot deduct personal living or family expenses.

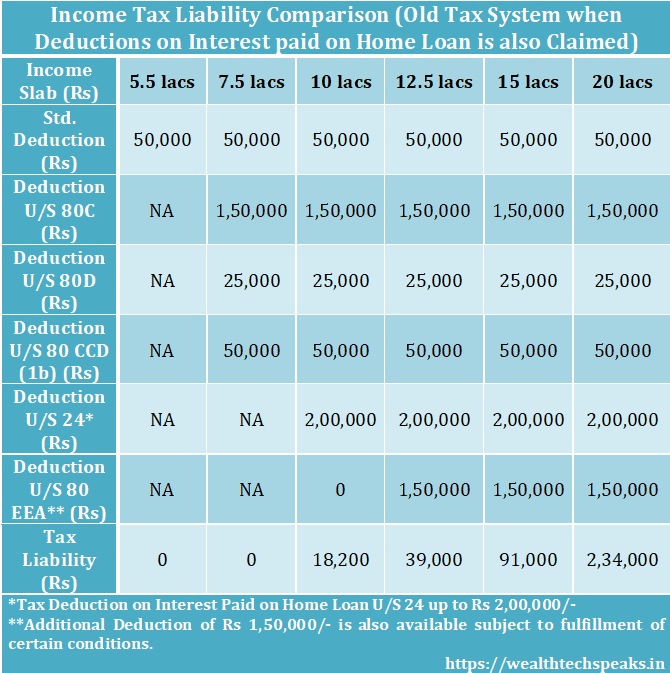

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

No depreciation shall be allowed on such assets.

Allowable Deductions For Web Design Business 2022. Following on from the previous example. Book magazines reference material Business gifts Business insurance Business meals Cabs subways buses Copying printing Cultural events museum entrance fees Equipment and software Film processing Gas and electric Hanging. Mileage deductions can be taken for charitable medical business and moving purposes.

1999 in the case of a person with severe disability allowable deduction is Rs. 16 cents per mile driven for medical or moving purposes. Use this list to help organize your design tax preparation.

However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the business and personal parts. The new deduction for up to 20 of qualified business income from a pass-through business entity such as a sole proprietorship partnership limited liability company or S corporation and. This allows Uber and Lyft drivers to deduct the cost of gas maintenance repairs.

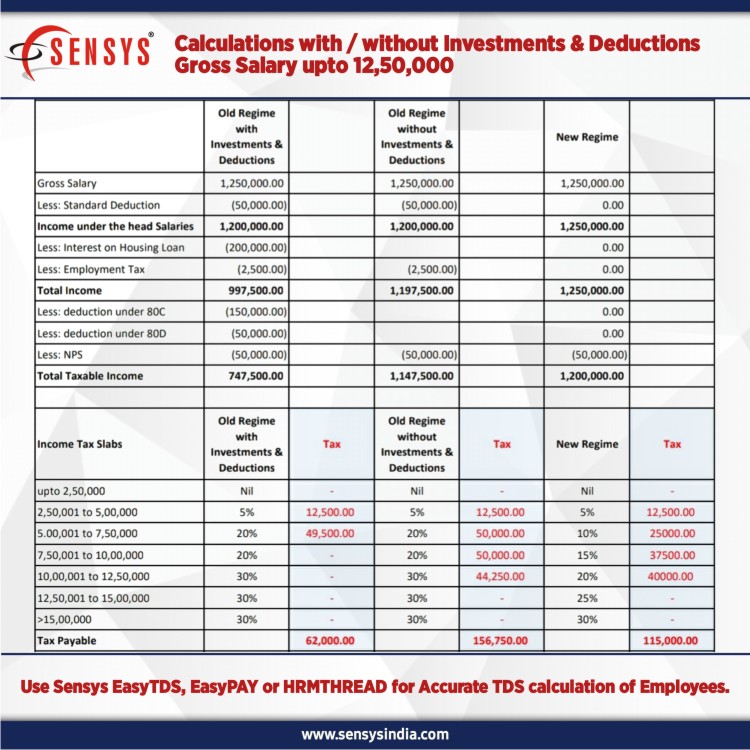

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Rebate Under Section 87a Ay 2021 22 Old New Tax Regimes

New Tax Regime Complete List Of Exemptions And Deductions Disallowed Basunivesh

20 Tax Deductions For Web Designers And Developers The Media Temple Blog

Tds Rate Chart For Fy 2021 2022 Ay 2022 2023

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

20 Tax Deductions For Web Designers And Developers In 2021

Tax Treatment Of Business Website Development Costs Blue Co Llc

Allowable Deductions While Computing Business Or Professional Income

The Tax Rules For Deducting The Computer Software Costs Of Your Business Sensiba San Filippo

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

Income Tax Comparison New Vs Old Fy 2020 21 Wealthtech Speaks

Is Your Website Tax Deductible

Beginner S Guide To Website Tax Deductions

Small Business Tax Deduction Checklist Businessnewsdaily Com

To Capitalize Or Expense How To Treat Website Costs For Tax Purposes Hantzmon Wiebel Cpa And Advisory Services

The Unrivaled List Of Small Business Tax Deductions 2021

Post a Comment for "Allowable Deductions For Web Design Business 2022"